Pop Quiz Doc. What was it Da Vinci Said About Sophistication?

By Wes Read CPA, CFP®

Jun 26 2020

Well, I can’t give you the answer just yet, but let me preface it. Compare these two doctors:

| Doctor A | Doctor B | |

| Age | 45 | 45 |

| Number of Practices | 3 | 1 |

| Number of business credit cards | 8 | 2 |

| Number of business checking accounts | 7 | 1 |

| Number of business loans | 11 | 2 |

| 401K in the Practice | No | Yes |

| Practice Value | $1,100,000 (Note, two of the practices aren’t profitable) | 1,100,000 |

| Annual Collections | 2,500,000 | 1,300,000 |

| Annual Profit (Pre-Tax and Pre-Debt) | 450,000 | 500,000 |

| Profit Margin | 18% | 38% |

| Practice Debt Payments | 150,000 | 85,000 |

| 401K/Profit Share Contribution of Doctor and Spouse | 0 | 74,000 |

| Tax Payments (FICA & Income) | 126,000 | 119,280

(Although she has a higher profit, she is contributing to a tax-deductible retirement plan, so her taxes are lower) |

| Take Home | 174,000 | 221,720 |

| Personal Spending | 180,000 | 168,000 |

| Surplus/Deficit | -6,000 | 52,720 |

| Cash in practice | 15,000 | 95,000 |

| Cash in Personal Reserve | 10,000 | 75,000 |

| Credit Card Balance in Practice | 45,000 | Always paid off |

| Owns stock | Yes. 4,253 of Apple stock (and talks about it all the time) | Yes. Within her 401K and IRA accounts. |

| Other ventures | Considering investing in his cousin’s private real-estate fund. Would need to pull cash from the practice. | One rental property. |

| Education Savings Account | No | Yes |

| Car | New Luxury Car. His son also drives an expensive car, though he never worked for it. | Slightly used luxury car |

| Student loans | Yes. But counting on the government to forgive the balance on the loan after only 12 more years! | Yes. But consolidated to a private loan at a 3.75% rate. Balance is decreasing quickly. |

| Stress Level | High | Low |

Alright, here’s the answer to our little quiz:

The ultimate sophistication is simplicity

– Mr. Leo DV

My examples above aren’t made up. The data is clear. Those doctors with a simple financial structure and healthy practice progress toward financial independence faster. And, doctors that keep it simple, tend to have less stress. This doesn’t mean they don’t work hard. They do. Maybe even harder. But they work smarter, and more focused. The rifle shot goes farther and impacts deeper than the shotgun.

Yet, we are so lured into the complicated. Perhaps it’s the dream of something beyond. Perhaps prestige. Or perhaps we simply like shiny stuff. But those doctors that keep it simple, run a decent practice, and live in financial stealth mode, are the ones that have cash in the bank and sleep well at night.

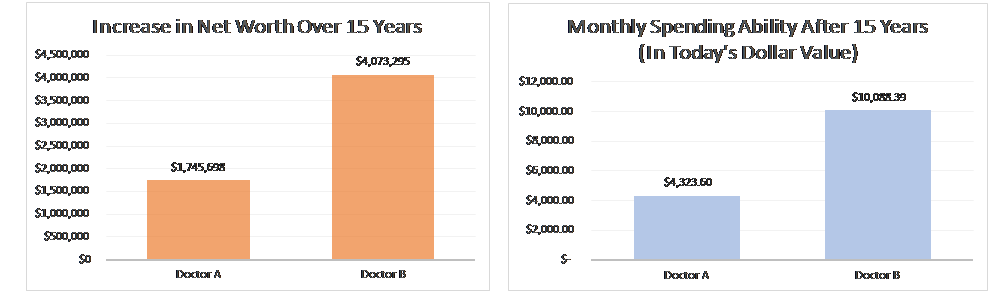

Back to doctors A and B. Doctor A’s net worth is increasing by $75,000 per year, largely from debt pay down. Dr. B’s is growing by $175,000, from both debt pay down and tax-deductible savings. At a 6% growth rate on assets, and a 4% withdrawal rate on those assets in retirement, look at the difference in (1) Net Worth and (2) monthly spending ability in retirement assuming a 4% allowable withdrawal rate.

Since my clients all know I love to hand out action items, here it is for you reader: Distill the number of investment accounts, offices, loans, credit cards, and unnecessary spending down to the basics. One business checking account. Two at the most. Same with credit cards. One or two practice loans. And a personal budget that is smaller than your income. Then focus on creating an awesome practice with awesome cash flow and an awesome financial future.

We know this as Occam’s Razor: The principal that, most of the time, simplicity is the most effective solution. His words literally translated were, “entities should not be multiplied unnecessarily.”

Copyright © 2025 All Rights Reserved. | Terms Of Service | Privacy Policy